What Is Comp Time And How To Calculate It?

.jpg)

Table Of Contents

Comp time, often referred to as compensatory time, is a type of paid time off that is given to employees in return for working longer hours than what is normally scheduled for them or under particular conditions, including on holidays or weekends.

Comp time is frequently utilized as a substitute for paying overtime earnings and is more common in the public sector than in the private sector (e.g., government agencies). To guarantee equitable remuneration and compliance with labor rules, it is crucial for both employers and employees to understand how to calculate comp time effectively.

This blog will define comp time, discuss its advantages and disadvantages, and provide a step-by-step tutorial on how to compute comp time in accordance with accepted procedures and legal requirements.

What Is The Meaning of Comp Time?

Comp time, sometimes known as "compensatory time," is a workplace term describing the practice of giving employees extra time off in exchange for working longer than their regularly allotted or scheduled shifts.

The employer gives the choice to accumulate comp time, which can be utilized as paid time off in the future, rather than paying overtime payments for the additional hours worked.

Is Comp Time Always Time and A Half?

Not all comp time is time and a half. Comp time accrual rates might change according on corporate policy, business customs, and applicable labor regulations. While time and a half is a typical rate for comp time accumulation (1.5 hours of comp time for each hour of overtime worked), it is not the only option.

One hour of comp time is awarded for every hour of occasional overtime worked (often referred to as "straight-time comp"), although alternative fractional rates may be offered by some businesses or organizations. The company's regulations or employment contracts should be very explicit about the regular rate at which comp time is paid.

It's vital to remember that each nation, state, or province may have different laws regarding comp time, as well as different regulations controlling its use. In certain countries, companies in the private sector may not be permitted to grant comp time at all, whilst businesses in the public sector may be subject to special rules and restrictions on its usage.

Private employers should make sure they are in compliance with applicable labor regulations to prevent any potential legal concerns, and salaried employees should be informed of their rights regarding overtime, comp time, and other types of pay. It is important to speak with a human resources person or a lawyer experienced in the applicable jurisdiction's labor laws if there are any queries or concerns regarding comp time.

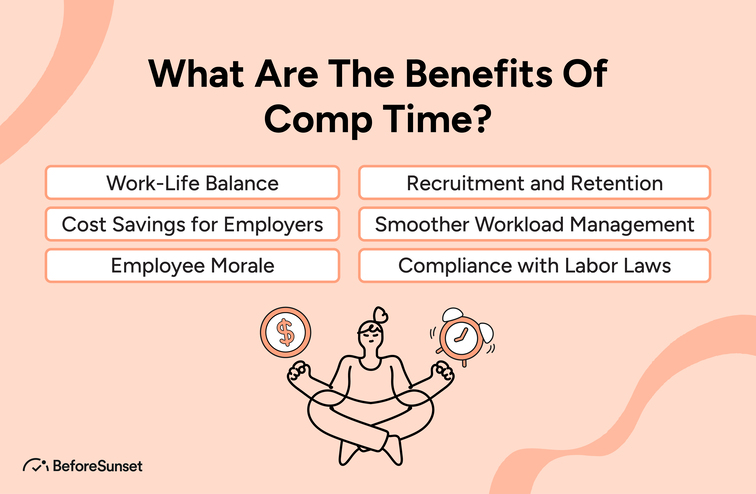

What Are The Benefits Of Comp Time?

Comp time has a number of advantages for both companies and employees when handled properly and in accordance with labor rules. Comp time has a number of important advantages, such as:

- Flexibility: Comp time gives staff members the freedom to take time off as needed. When people have responsibilities to their families or personal lives, wish to go to functions, or just need a vacation from work, this might be extremely helpful.

- Work-Life Balance: Employees can improve their work-life balance by accruing comp time and using it as paid time off. As a result, workers may be more motivated and productive due to greater job satisfaction and less burnout.

- Cost Savings for Employers: Offering comp time instead of paying extra earnings can save firms money. Private employers can better control labor expenditures by offering time off rather than higher compensation.

- Employee Morale: Knowing that they can earn comp time for overtime work might help to raise employee morale. It may serve as a means of honoring and rewarding them for their commitment and diligence.

- Recruitment and Retention: Offering additional benefits like comp time might be enticing to candidates throughout the hiring process. Because workers could feel more respected and supported in their requirements for a work-life balance, it might also lead to increased rates of employee retention.

- Smoother Workload Management: By providing comp time, businesses may encourage staff to take advantage of their accumulated vacation time at slower times, resulting in a more even distribution of effort throughout the year.

- Compliance with Labor Laws: Comp time can assist companies in maintaining compliance with labor laws and rules pertaining to overtime compensation and working hours when it is permitted and properly handled.

Does Federal Comp Time Expire?

There is no federal regulation in the US requiring businesses in the private sector to give their staff comp time (compensatory time) in place of overtime rate pay. However, under some circumstances, companies in the public sector (such as government agencies) are permitted to provide comp time to their staff under the Fair Labor Standards Act (FLSA), which regulates minimum wage and hour laws.

The FLSA mandates that comp time must accumulate and be spent within specific time frames for employers in the public sector. Employees in the public sector are required under the FLSA to spend accrued comp time within 26 weeks (about six months) of when it was earned. If the employee does not use the comp time within this time frame, the company is required to reimburse them at their usual hourly rate.

The regulation of comp time for public sector employees can also be influenced by state and municipal legislation, and these regulations may have extra or different rules for accrual and expiration. Employees and employers in the public sector must thus be informed of the unique rules and regulations that are applicable in their area.

Employer regulations, employment contracts, or collective bargaining agreements, as opposed to federal law, would regulate any compensatory time policies or agreements for employees working in the private sector. In such circumstances, the employer's policies and relevant state legislation would govern the comp time expiry restrictions, assuming any exist at all.

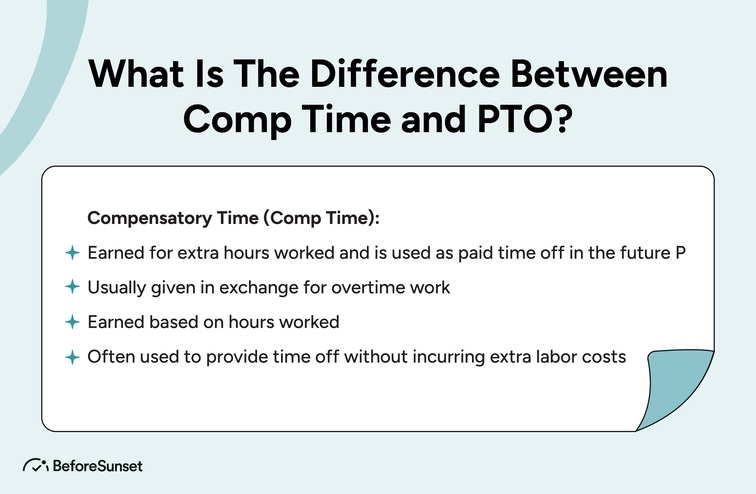

What Is The Difference Between Comp Time and PTO?

PTO (paid time off) and Comp time (compensatory time) are both types of time off that businesses offer, but they have distinct uses and are sometimes controlled by separate laws and rules. The following are the main distinctions between comp time and PTO:

Compensation Time (Comp Time):

The purpose of comp time is to compensate employees for working more hours over their usual workday or for working at particular times, such the weekend or on holidays.

- Overtime Rate Compensation: Some businesses, particularly in the public sector, may give comp time as an alternative to paying overtime hour earnings for the additional hours worked. Comp time can be accumulated at a faster rate than ordinary hours worked, such time and a half or more.

- Applicability: Comp time may be subject to certain rules and restrictions under the Fair Labor Standards Act (FLSA) and is more frequently employed in the public sector (such as government agencies).

- Time Off Usage: Subject to any restrictions imposed by law or business regulations, employees may utilize their accumulated comp time as paid time off, often at a period agreed upon with their employer.

PTO (Paid Time Off):

- Purpose: PTO, which is used more broadly, refers to a variety of leaves, including personal days, sick days, vacation days, and occasionally even comp time. It is given to employees as a perk that they may use anyway they see appropriate, whether it be for personal usage, time off for vacation or sickness, or other purposes.

- Overtime Compensation: PTO isn't particularly connected to overtime labor. It is often given to employees whether or not they put in additional time.

- Applicability: PTO is often utilized in both the public and commercial sectors, and there are wide variations in PTO availability and policy between workplaces.

- Time Off Usage: Per the regulations of their employer, employees may utilize PTO for any authorized purpose. It offers additional flexibility and may be utilized for both personal and recreational activities as well as for emergencies or medical issues.

Compensatory Time vs. Overtime

Compensatory time and overtime are two distinct concepts related to how employees are compensated for working beyond their regular work hours. Let's clarify the differences between compensatory time and overtime:

Compensatory time, often abbreviated as "comp time," is a form of time off provided to employees as compensation for working extra hours beyond their regular flexible schedule.

It is an alternative to paying overtime wages and is more commonly used in the public sector (e.g., government agencies) than in the private sector. Comp time allows employees to accumulate time off for future use, based on the number of extra hours they have worked.

Key features of compensatory time:

- Earned Time Off: Employees accrue comp time based on the number of overtime hours worked. The accrual rate may be 1.5 hours of comp time for each hour of overtime worked (time and a half) or another agreed-upon rate.

- Time Off Usage: Employees can use their accrued comp time as paid time off, typically with their employer's approval and subject to any limitations or policies set by the employer or applicable regulations.

- Expiration: In the public sector under the Fair Labor Standards Act (FLSA), comp time must usually be used within 26 weeks (approximately 6 months) of being earned, after which it must be paid out to the employee at their regular wage rate.

- Overtime: Overtime is the additional pay that employees receive for working beyond their regular work hours. In most jurisdictions, including the United States under the Fair Labor Standards Act (FLSA), eligible employees are entitled to receive overtime pay, usually at a rate of 1.5 times their regular hourly wage, for each hour worked beyond 40 hours in a standard workweek.

Key features of overtime:

- Extra Pay: Overtime compensation is paid to employees in the form of extra wages. It is typically calculated as time and a half (1.5 times the regular hourly wage) for each hour worked beyond the standard workweek.

- Immediate Compensation: Unlike comp time, which provides time off in the future, overtime pay provides additional wages in the same pay period in which the extra hours were worked.

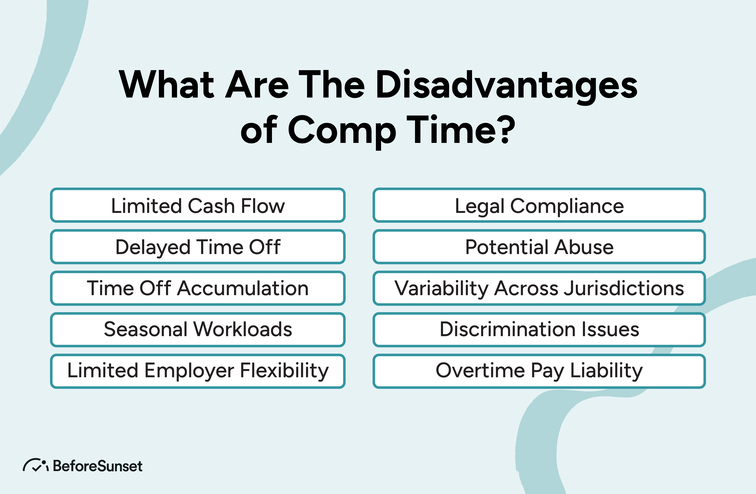

What Are The Disadvantages of Comp Time?

Comp time has several advantages, but it also has some drawbacks that might affect both companies and employees. The following are some disadvantages of using comp time:

- Limited Cash Flow: Comp time gives employees time off rather than instant payment for overtime labor. For people who require the additional funds to meet urgent costs or financial obligations, this may be a drawback.

- Delayed Time Off: When an employee requests time off, comp time may not always be authorized for usage. Comp time usage limits imposed by employers may make it difficult to take time off when needed.

- Time Off Accumulation: It could be difficult for employees to use up all of their earned vacation time in the given time. Employees risk losing earned time if it lapses if the business does not provide options for cashing out excess comp time.

- Seasonal Workloads: Workers may accrue comp time during busy times but struggle to use it during calm times in industries with seasonal peaks and troughs of activity.

- Limited Employer Flexibility: Employers have limited flexibility in managing employee requests for comp time off while yet maintaining the required workforce coverage. It might be difficult to strike a balance between comp time requests and operational needs.

- Legal Compliance: Offering comp time may be subject to certain legal obligations in some jurisdictions or for some companies. There may be legal repercussions if labor laws are not followed.

- Potential Abuse: If the employer has loose procedures or insufficient tracking mechanisms, comp time may be misused or abused by employees.

- Variability Across Jurisdictions: For businesses who operate in various locations, the laws and regulations governing comp time might differ dramatically between jurisdictions.

- Discrimination Issues: If comp time regulations are not applied equally and consistently, it may give rise to discrimination issues if some employees are often rejected requests for comp time.

- Overtime Pay Liability: Employers in the private sector may not be allowed to give comp time in place of overtime compensation in some areas. Inadvertently offering comp time when it is not permitted might result in legal problems and consequences for the employer.

What Happens To Comp Time When You Retire?

Depending on the employer's rules and any relevant labor regulations, how collected compensatory time (comp time) is handled after an employee quits might change. Employers may occasionally have rules that permit retiring workers to receive a payment for any unused vacation time, depending on the employee's hourly rate at the time.

A different option is to convert comp time into paid time off (PTO) and add it to the employee's already existing PTO balance, allowing them to utilise the earned time before leaving the company.

Unused comp time may be forfeited without further compensation in some jurisdictions or organizations where there may be no particular procedures for paying comp time upon retirement.

To understand what happens to collected comp time upon retirement and to be aware of any legal obligations that may apply, employees should check their employer's rules and speak with their HR department or supervisor.

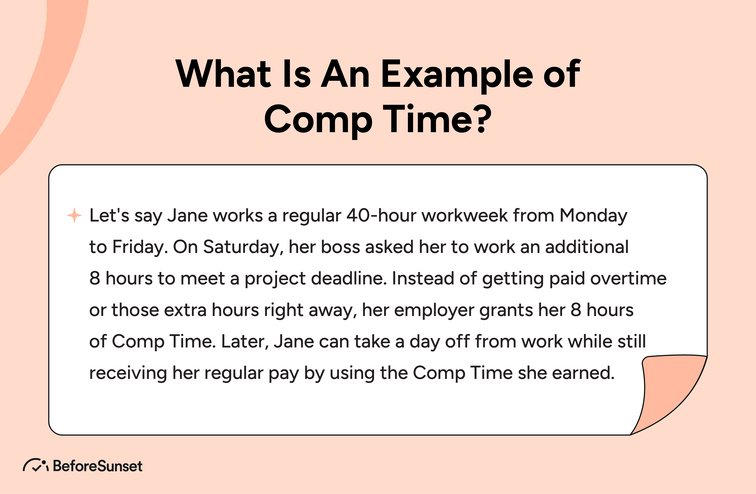

What Is An Example of Comp Time?

To demonstrate how comp time functions, let's look at an example:

Consider Alex, a worker at a government organization. Their standard workweek is 40 hours, and if they work more than that in a week, they are entitled to overtime compensation.

Alex's team is working on a challenging project over a specific week, and they have to put in additional time to finish it by the deadline. Alex works a total of 48 hours throughout that week, which included 8 hours of overtime.

The government organization offers comp time as an option to paying Alex for the overtime hours at a rate of time and a half (1.5 times their usual hourly income).

Alex would receive 12 hours of comp time (1.5 hours of comp time for each hour of overtime worked) if the rate of comp time was 1.5. This indicates that they would receive 12 hours of comp time in addition to their usual 40-hour workweek.

Alex can now decide to take future paid time off in lieu of the accumulated comp time. If they want to take a day off, for instance, they can use their 12 hours of comp time to collect their full compensation for the day even if they weren't at work. They can also reserve their comp time for a future need, such as a personal or family trip.

It's important to keep in mind that each business and jurisdiction may have different comp time regulations and rates. Different comp time accrual rates, expiry regulations, and other guidelines may apply at some businesses. To understand how comp time applies to their particular circumstances, employees should educate themselves with their employer's rules and any applicable labor regulations.

How Do You Calculate Comp Time?

Calculating comp time involves determining the amount of compensatory time off that an employee has earned for working extra hours beyond their regular work schedule. The calculation can vary based on the employer's policies and any applicable labor laws. Here's a general formula for calculating comp time using a time and a half (1.5) rate:

Determine Overtime Hours: Identify the total number of overtime hours the employee has worked during a specific period. Overtime hours are any hours worked beyond the employee's regular work schedule, which is typically 40 hours per week in countries where this is the standard.

Calculate Comp Time: Multiply the number of overtime hours by the comp time rate. The comp time rate is usually 1.5, representing one and a half hours of comp time for each hour of overtime worked.

Formula: Comp Time = Overtime Hours * Comp Time Rate

For example, if an employee has worked 8 hours of overtime in a given week, the calculation would be:

Comp Time = 8 Overtime Hours * 1.5 Comp Time Rate Comp Time = 12 hours

In this example, the employee has earned 12 hours of comp time for that particular week.

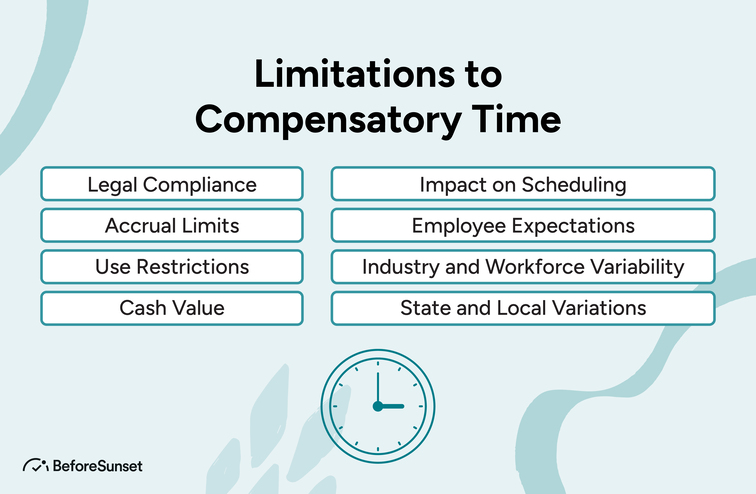

Limitations to Compensatory Time

Comp time, often known as compensatory time, has several restrictions that both employers and employees need to be aware of. Depending on the jurisdiction, the nature of the work, and corporate regulations, these restrictions may change. The following are some typical restrictions on compensatory time:

- Legal Restrictions: Employers in the private sector are frequently prohibited from substituting comp time for overtime compensation. For instance, the Fair Labor Standards Act (FLSA) in the US limits the use of compensatory time in the private sector and mandates that businesses pay overtime earnings for hours worked above the typical workweek.

- Maximum Accruals: An employee's ability to accrue comp time may be capped by their employer. Any further overtime hours worked may not result in additional comp time accumulation once the maximum accrual has been achieved until the employee takes advantage of part of the accrued vacation time.

- Expiration of Comp Time: Comp time may have a deadline by which it must be spent. If the comp time is not used within the allotted period, it might be forfeited, or the company would have to compensate the employee for the unutilized comp time.

- Approval for Use: Depending on operational requirements, employers may have the authority to accept or reject requests to use comp time. This can cause delays or limitations on when workers can use their accumulated vacation time.

- Cash Payout Rules: Some firms may have rules that permit workers to obtain a cash payment in lieu of vacation time for accumulated comp time. But there could be some limitations or constraints on this.

- Limited Applicability: Comp time is often more prevalent in the public sector than the private sector (e.g., government agencies). As a result, not all workers may be able to take advantage of comp time benefits.

- Collective Bargaining Agreements: In unionized companies, comp time may be negotiated and agreed upon through collective bargaining, which may impose further restrictions or guidelines.

Is Comp Time Legal?

Comp time's legality is determined on the jurisdiction and the kind of employer. Comp time, often referred to as compensatory time, is typically permitted in the public sector, such as in government organizations, in many nations, including the United States. Its legality in the private sector can differ, though, and it can even be illegal in some regions.

For instance, the Fair Labor Standards Act (FLSA) in the United States regulates labor rules pertaining to overtime compensation and comp time. According to the FLSA, businesses in the private sector must typically pay qualified workers overtime compensation (often at a rate of 1.5 times their normal hourly salary) for any hours worked in excess of 40 in a typical workweek.

Employers in the private sector are not permitted to substitute comp time for overtime laws pay, with the exception of some sectors where there are exemptions or special rules.

On the other hand, under specific circumstances, businesses in the public sector, such governmental organizations, may give their staff comp time. Employers in the public sector are permitted by the FLSA to offer comp time instead of overtime compensation, but only under certain conditions.

In the public sector, comp time must be collected and utilized within set deadlines; if not used by the deadline, the employer is required to reimburse the employee for the wasted comp time.

To maintain compliance, it is essential that both employers and workers are aware of the rules and legislation pertaining to comp time in their various jurisdictions. In the event that there are any uncertainties or concerns regarding the validity of comp time, it is important to consult with legal experts who are knowledgeable about the applicable region's labor regulations.

Who Can Earn Compensatory Time?

Depending on the jurisdiction and the kind of company, different people may be eligible to receive compensatory time, commonly known as comp time. Comp time is often linked with the public sector (such as government agencies) in many nations, including the United States, and may be restricted or forbidden in the private sector.

Here is a broad breakdown of who is eligible to get comp time in various contexts:

- Public Sector (Government Agencies): At the federal, state, or municipal levels, comp time is frequently provided to employees in the public sector, which includes government agencies. Employees in the public sector may be qualified to receive comp time instead of overtime compensation, according to the precise restrictions and guidelines outlined by labor legislation.

- Private Sector: Comp time eligibility is often more limited in the private sector. In the US, for instance, the Fair Labor Standards Act (FLSA) mandates that private sector companies pay qualified employees overtime compensation (often at a rate of 1.5 times their normal hourly salary) for any hours worked in excess of 40 in a typical workweek. Employers in the private sector are not permitted to substitute comp time for overtime pay, with the exception of some sectors where there are exemptions or special rules.

- Workplaces with Unions: In certain unionized workplaces, the employer and the labor union that represents the employees may negotiate and come to an agreement about the eligibility for comp time. In such circumstances, the collective bargaining agreement would set forth the rules and conditions for accruing comp time.

Comp Time For Exempt vs Non-Exempt Employees

Compensatory time (comp time) may be offered to both exempt and non-exempt employees, but the rules and regulations governing its use can vary significantly based on an employee's classification under labor laws. Here's how comp time may differ for exempt and non-exempt employees:

Exempt Employees:

- Exempt employees are typically salaried workers who are exempt from overtime pay requirements under the Fair Labor Standards Act (FLSA) in the United States. They do not receive overtime pay regardless of the number of hours they work beyond the standard workweek.

- Since exempt employees do not receive overtime pay, they are generally not eligible for comp time either. Comp time is primarily associated with the public sector (e.g., government agencies) and may not be applicable to exempt employees in most private sector settings.

Non-Exempt Employees:

- Nonexempt employees are workers who are entitled to overtime pay for any hours worked beyond the standard workweek, usually 40 hours in many jurisdictions.

- Nonexempt employees may be eligible to earn and use comp time, subject to specific regulations and limitations set forth by labor laws. However, in many private sector settings, comp time is not an option for nonexempt employees. Instead, they are entitled to receive overtime pay for any overtime hours worked.

Private vs Public Sector Employees

Due to the various labor rules and regulations that each sector is subject to, employees in the private and public sectors are treated differently when it comes to compensatory time (comp time).

Under the Fair Labor Standards Act (FLSA) in the United States and many other nations, comp time is typically not permitted as an alternative to overtime compensation in the private sector. Employees in the private sector are entitled to time and a half overtime compensation for any hours worked over the typical workweek.

Contrarily, comp time is more frequently provided to workers in the public sector, such as those employed by governments, under strict guidelines established by the FLSA and other labor regulations.

Subject to specific restrictions and expiration dates, public sector personnel may accumulate comp time for overtime hours worked and use it as paid time off in the future. Depending on the geographical jurisdiction and any applicable collective bargaining agreements for public sector employees, the availability and usage of comp time may change.

States Allowing Comp Time In The Private Sector

The Fair Labor Standards Act (FLSA), a federal law, regulates the standards for overtime compensation in the private sector and prohibits the use of comp time in place of overtime pay.

It's important to remember that labor laws can change, and that state regulations may have been updated or changed since my previous update. It is advised to contact the labor department or legal resources in the particular state of interest for the most up-to-date and accurate information.

Comp time is often not permitted in the private sector, although it is frequently utilized in the public sector (such as government agencies) in some countries, subject to certain laws and restrictions. Employers in the public sector are permitted to substitute comp time for overtime compensation for qualified workers. However, they must adhere to all applicable labor rules and regulations.

Penalties For Illegal Use Of Comp Time

The penalties for the illegal use of compensatory time (comp time) can vary depending on the specific labor laws and regulations in the jurisdiction and the severity of the violation.

In general, using comp time unlawfully in the private sector or not adhering to the regulations for comp time in the public sector can result in legal consequences and financial liabilities for employers. Here are some potential penalties for illegal use of comp time:

Private Sector Employers:

- Violation of Fair Labor Standards Act (FLSA): Using comp time in the private sector as an alternative to overtime pay, when not allowed by the FLSA, could lead to legal action by employees. Employers may be required to pay the owed overtime wages to affected employees, along with potential fines and penalties imposed by labor authorities.

- Lawsuits and Claims: Employees who have been denied overtime pay or appropriate compensation for their work hours may file lawsuits or wage claims against the employer. If the employer is found to be in violation of labor laws, they may be liable for back wages, liquidated damages, and attorney fees.

Public Sector Employers:

- Non-Compliance with Labor Laws: Public sector employers who fail to comply with the regulations for comp time set forth by the Fair Labor Standards Act (FLSA) or other relevant labor laws could face penalties from labor departments or government agencies.

- Payment Obligations: If public sector employers improperly handle comp time accrual or use, they may be required to pay employees for the unused comp time, even if it has expired or been forfeited.

How To Use Comp Time In Your Business

To guarantee compliance with labor regulations and to fulfill the needs of both the organization and its employees, using comp time in a business involves the establishment of defined policies and processes. Here are some tips for using comp time at your company:

Create a thorough comp time policy that specifies the qualifying requirements, accrual rates, maximum accrual limits, use guidelines, and any related expiration dates. Verify that the policy conforms with all applicable labor laws and rules.

Clearly explain the comp time policy to all staff members so they are aware of how it operates, how it is accumulated, and when it may be utilized. Ensure that staff members are informed of their comp time rights and obligations.

Implement a system to precisely track and record each employee's accrual of comp time as well as its use. To maintain accurate and current data, use a timekeeping system or HR software.

Establish a procedure for employees to seek comp time off, and make sure that requests are swiftly examined and taken into account by operational requirements. Employees should be encouraged to schedule and request comp time ahead of time wherever feasible.

Ensure that supervisors or managers have the power to accept or reject requests for comp time depending on organizational needs. To avoid the appearance of partiality, handle comp time requests in a fair and consistent manner.

Establish explicit guidelines for how collected comp time expires and any appropriate compensation mechanisms for unused comp time. Ensure that all labor laws and any contractual commitments are followed.

Consistently assess the comp time policy and processes to make sure they're still relevant and useful. Make changes as necessary to comply with labor rules and adapt to changing company demands.

To prevent any legal problems and guarantee uniformity in its implementation, teach managers and HR staff how to properly administer comp time.

BeforeSunset and Comp Time

BeforeSunset can significantly streamline the management of comp time within a business by automating various processes and ensuring accurate tracking. With built-in time tracking and accrual features, employees can easily log their overtime hours, allowing the software to calculate and manage comp time accruals seamlessly.

.png)

.png)

.png)

.png)